Wish you knew where your competitors are investing this year? Geonetric’s popular survey reveals top areas for growth, not only looking at staffing but also uncovering areas provider organizations are outsourcing or investing in infrastructure.

Each time we produce our Healthcare Digital Marketing Trends Survey results, one of the most popular topics is around staffing. As we’re putting the finishing touches on the eBook, I thought I’d take this opportunity to share a sneak peek at some of the trends in teams and staffing we’re uncovering.

Last year we reported on healthcare digital marketing’s “Top Jobs” – the top areas where healthcare systems were looking to add staff to support their digital marketing operations. This year, we looked at staffing a little more broadly, since staffing is only one indicator of where an organization is investing.

This year, we looked at the areas of growing investment for both staff and other investment including tools and outsourced support.

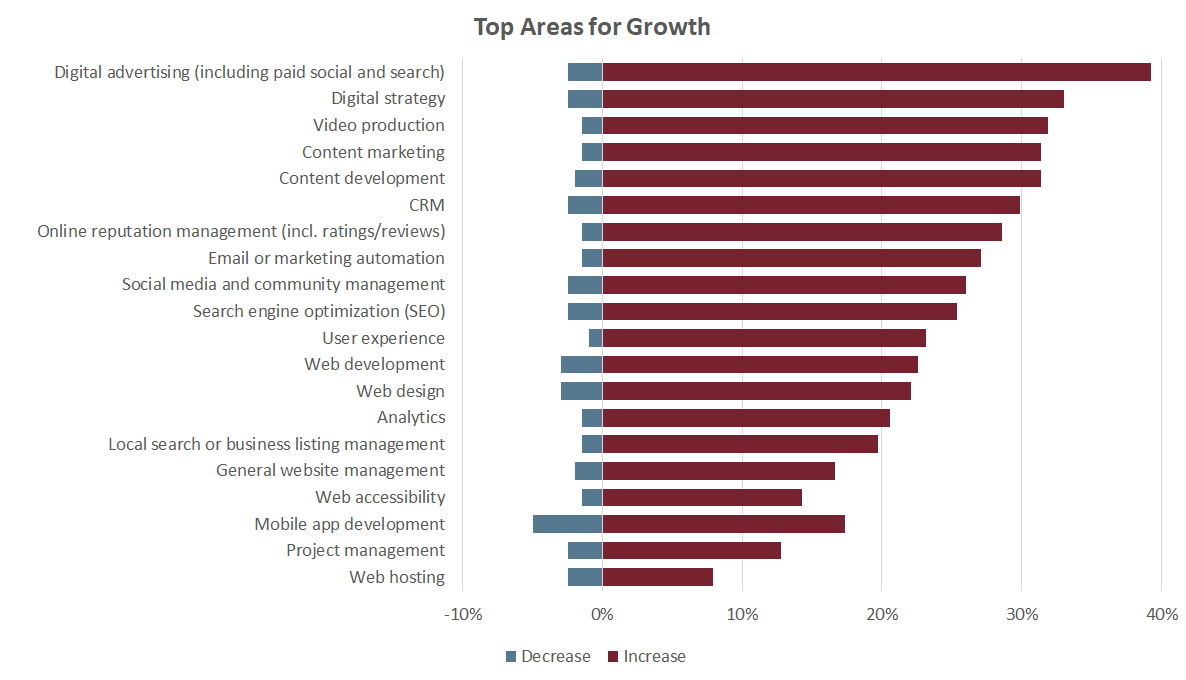

Top Growth Areas

The first observation, and no real surprise here, healthcare digital marketing teams are increasing their net investment in every area. The single top growth area by a wide margin is digital advertising, followed by digital strategy, video production, content marketing, and content development. Areas with the least planned investment growth are mobile app development, project management, and web hosting.

Those of you who follow our digital survey each year know we break respondents into self-reported segments: leaders (those ahead of competitors in certain areas), average (those keeping up with competitors), and laggards (those falling behind.) When looking at those areas of investment across these segments, patterns of growth are similar with a few notable exceptions:

- Leaders are more aggressively growing their capabilities for CRM and analytics

- Laggards are investing in core areas such as digital strategy and project management

The question that emerges is: do these investment priorities make sense given the other data we’ve collected? Or, from another perspective, how are healthcare organizations prioritizing their top areas for growth?

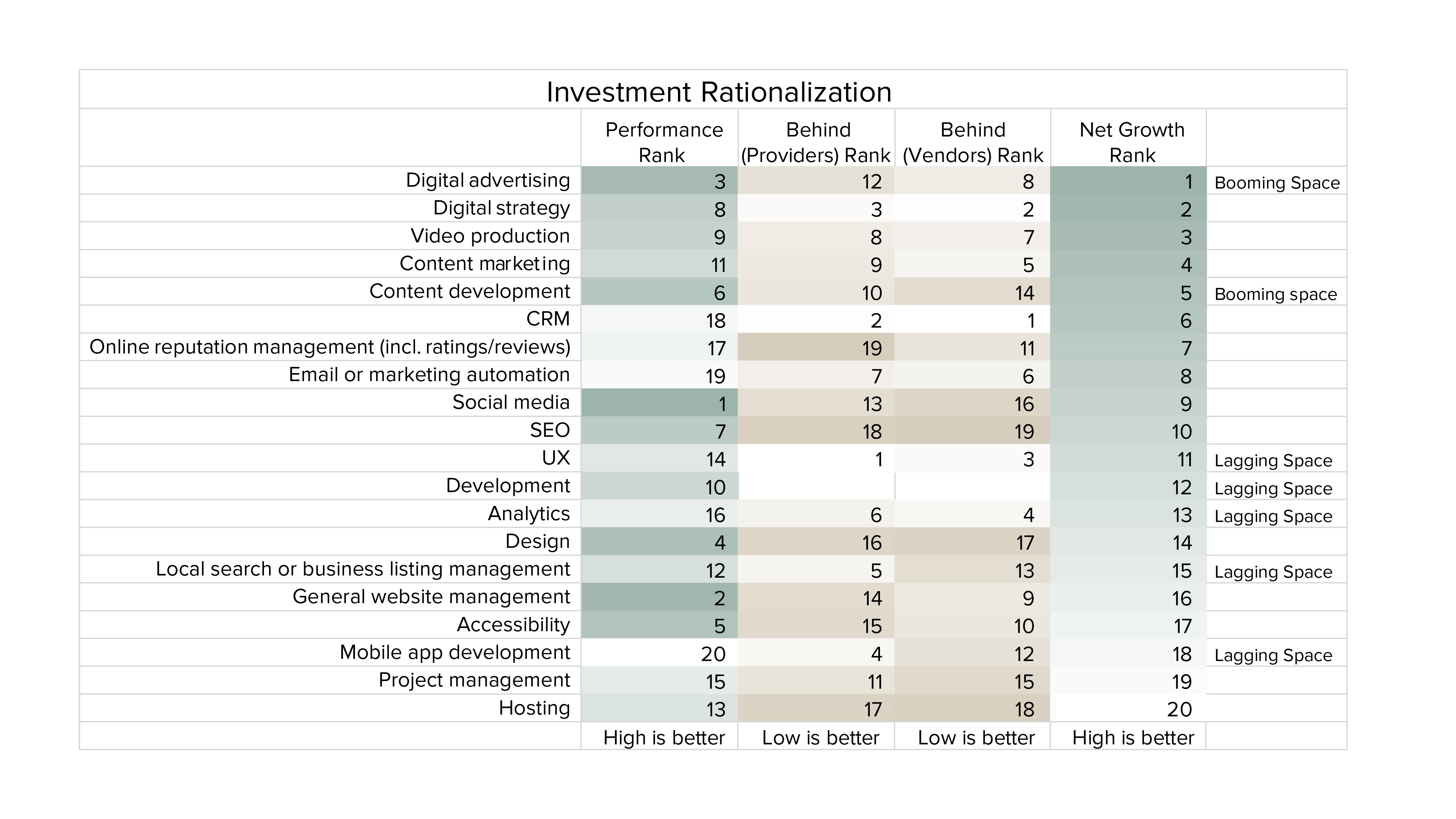

Investment vs. performance, plus outside perspective

To explore this further, we look at several other questions from the survey—providers’ self-reported performance in each of these areas along with the rankings of where healthcare is behind other industries from the perspective of providers themselves and of their vendor and agency partners.

Note: For this post, I’m using only the rank order of each of these items for comparison. For more detailed information, download the entire report when it’s available.

There are a number of areas where the data across these questions line up very cleanly.

Take general website management, for example. It’s one of the areas where healthcare organizations feel that they’re performing well (#2 on their list), it falls fairly low on the list of areas where healthcare is falling behind other industries (#14 for providers and #9 for vendors) and is a lower priority for new hiring (#16 overall).

But not all of the investment priorities for the coming year line up in that way. Let’s take a closer look to see what’s going on for those areas.

Areas that are booming or lagging

To start, there are two functions that are booming: digital advertising and content development.

Digital advertising is a space where healthcare organizations rank their performance highly relative to competitors (#3), don’t see themselves falling behind other industries (#12), and even their vendor partners see them holding up fairly well (#8). Despite all of this, digital advertising is the top area of increased hiring and investment for the coming year!

Content development is a similar scenario. Despite already being competitive, it is high on the list of new investment priorities.

The bottom line is that health systems are doubling down in digital advertising and content development because these are areas that are giving them great lift right now – and probably for slightly different reasons.

Organic reach is shrinking across the board – from social media to search engines. It’s an increasingly a pay-to-play world and healthcare organizations are using paid advertising more than ever.

Great content is the tide that lift all ships. When you have great content and a process that allows you to develop more great content over time, all of the other tactics that you’re implementing with digital become that much easier and that much more effective.

At the other end of the spectrum, we have some lagging spaces: user experience (UX), development, analytics, business listing management, and mobile app development. Even with the perceived shortcomings in these areas, health systems are just less likely to be able to prioritize growing investment in these areas amongst all of the other areas requiring new resources.

Where should you invest

At the end of the day, your growth priorities are mostly about where your organization is today and where you’re in need of expanding capabilities. The insights here aren’t telling you where to invest but they do give us an indication of where your competitors will likely be getting better in the coming year and where they’re seeing outsized value in the investments that they’re making today.

Prepare to see healthcare organizations growing digital advertising, investing in strategy, upping their game in the content realm – particularly in terms of video – and pushing ahead in CRM although still not as fast as their agency partners think that they should be.

Within that, however, we see our booming spaces. Healthcare marketers are doing well in online advertising and content. There’s already significant investment here in both staff and dollar terms. And, despite that, your competitors are doubling down in these areas. Not investing because they’re behind but because they’re seeing so much value for the investments that they’re making. It’s hard to go wrong growing your capabilities in these areas.

And that’s one strategy.

But there’s another way to go. Look at the lagging spaces. These areas seem ripe for investment, but respondents aren’t looking to fill those gaps for whatever reason. Maybe the payoff is less direct? Maybe they think that mediocre is good enough? Maybe they’re still searching for worthwhile use cases for mobile apps?

Or maybe they’re missing the opportunity? Investing in areas like analytics or business listings could just be your opportunity to leapfrog the competition or maintain your lead.

It’s our hope that this information along with many other insights in our upcoming webinar and our survey report can help you invest strategically rather than in response to the latest trend or the squeaky wheel in your organization.