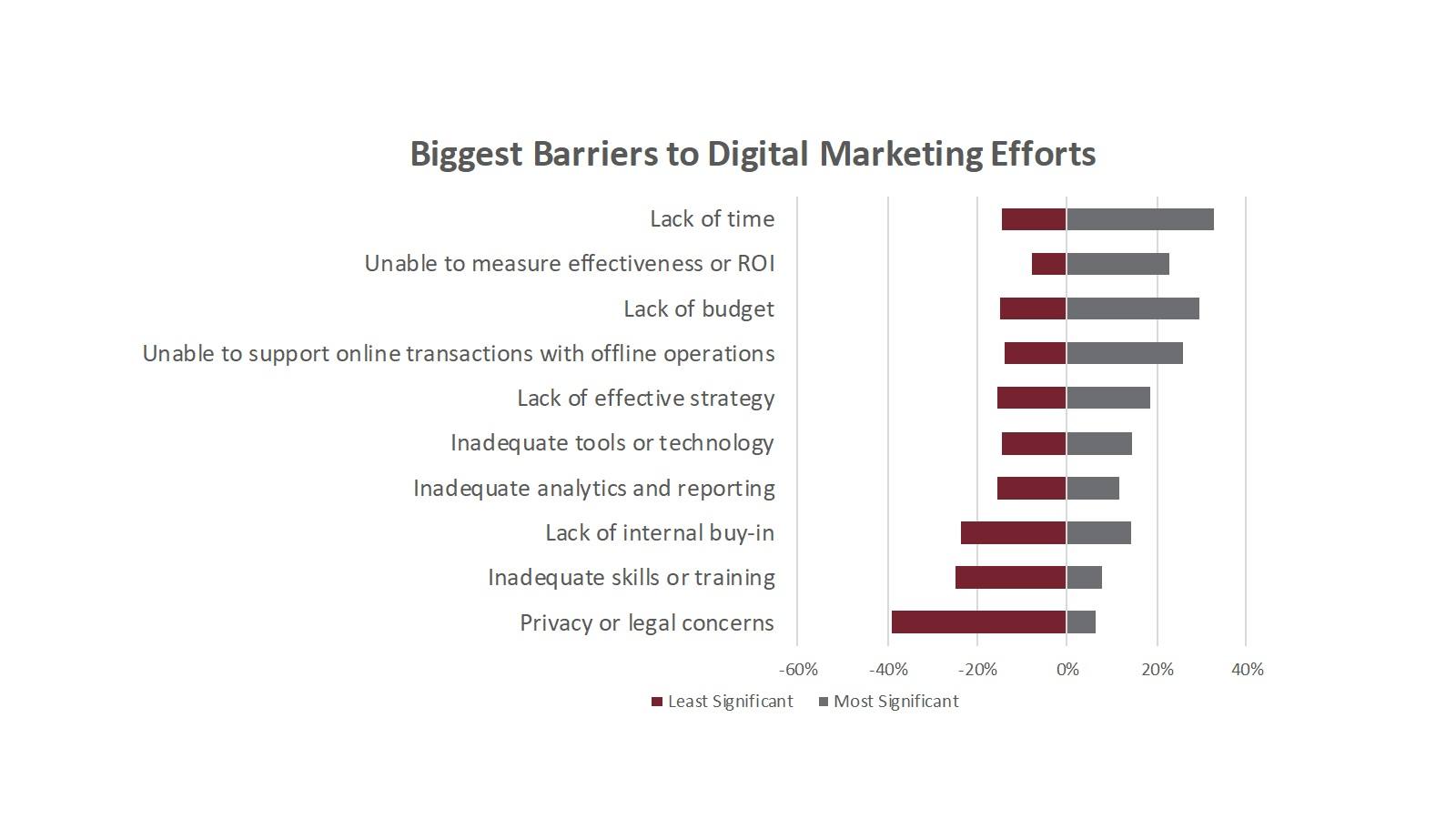

Over the last few years of administering the Healthcare Digital Marketing Trends Survey, digging into what challenges healthcare marketers face has proven to be an important piece in understanding the state of digital marketing.

Traditionally, “lack of time” and “lack of budget” have always been at or near the top of the barriers list.

In last year’s survey, we encountered a surprise: “unable to measure effectiveness or ROI” emerged at the top of the list and remained near the top again this year, slipping to the number two spot. This had always been high on the list in the years when we posed this question to agency/vendor respondents, but it usually placed low for the health system’s concerns. The increased priority for calculating return on investment (ROI) was a recognition that while resources, in the form of time (staff) and budget, are barriers the failure to make the case for those resources is an important underlying cause of those previously mentioned challenges.

Online transaction and offline operations

The surprise factor this year was that “unable to support online transactions with offline operations” found its way to #4 on the list of top barriers, just behind resources and the aforementioned ability to measure ROI.

Last year we saw this begin to emerge as a concern, but only from respondents who self-identified as outperforming their competitors across numerous digital strategy areas.

Leading digital healthcare organizations are reaching the points where new online capabilities are a catalyst to create changes not only in marketing but also in the way in which healthcare services are accessed, delivered, and funded. The changes that are made possible through digital transformation require internal process changes or, at the very least, cooperation from other parts of the enterprise.

Now we’re seeing operational challenges emerge across many more organizations in our survey, even those who do not see themselves as digital leaders.

This is likely because average and laggard organizations have invested in the last few years in their martech stacks, which inevitably leads to operational questions.

Types of operational challenges

Digital transformation forces clarity around processes, which often leads to lots of internal conversations about how to handle incoming requests.

Some of the most common ways we see healthcare organizations run into process challenges is from web transactions. For example:

• Appointment setting: This is often one of the first digital-to-operational challenges organizations face, and it’s often because internal processes haven’t been standardized. Scheduling is often decentralized with individual clinics or practices following different processes from one another let alone standardizing with hospitals! Many organizations still push online visitors to use the phone to schedule an appointment, which goes against the way many site visitors want to interact with the organization and could impact the user experience. As online appointment options expand, particularly with real-time appointment scheduling, this is an area that will continue to be a headache for many until they standardize their processes.

• Customer Relationship Management (CRM): For the last few years, we’ve seen organizations indicate on the survey that they are investing in CRM technology and CRM team skillsets. CRM implementations make it possible to get a complete overall view of a consumer and how they engage your organization through in-patient, outpatient, and non-clinical touchpoints. Integrating CRM with your website creates the opportunity to build a better understanding of a customer’s interests in your organization and can open the door to deliver more personalization experiences both online and offline. Creating this consolidated view of your customers and using that data to create meaningful experiences opens up numerous operational challenges from I.T. to call center to the bedside. Though not easy to accomplish, this type of transformation can pay big dividends in improved patient acquisition, satisfaction, and retention.

• Delivering on marketing ROI: Being able to track the financial impact of attracting new patients is the holy grail of digital marketing. Many aspire to do it but have trouble delivering. Despite growing CRM adoption by healthcare systems, most organizations still struggle with tying financial results to marketing efforts. Equally problematic are marketing strategies that make new patient attribution difficult, a shortage of online patient conversion opportunities, an inability to track health consumers across marketing engagement channels to becoming a patient, and identify where the conversion funnel could be improved.

As organizations think strategically about moving the offline processes to the web, healthcare marketers will need to be proactive in building relationships with operations, finance, and I.T. to avoid pitfalls as your digital systems push those boundaries.

Download the survey and learn more insights

The 2019 Healthcare Digital Marketing Trends Survey is full of additional insights around how healthcare marketers are using digital tactics to engage and convert today’s health consumers. Download the free survey report today and learn where your organization and gain understanding into how your peers and competitors are planning, budgeting, and staffing for the coming year.